Changes of Online Game Market: Total Income of Six Giants Decreased

The change of online game market is constant process.Revenues of half the six giants decreased quarter by quarter, including Shenda、Perfect World、Giant.This is the first time that the growth become negative after 2009,obviously is a dangerous signal.

7k7k新闻出海 筹备中敬请期待

The change of online game market is constant process.

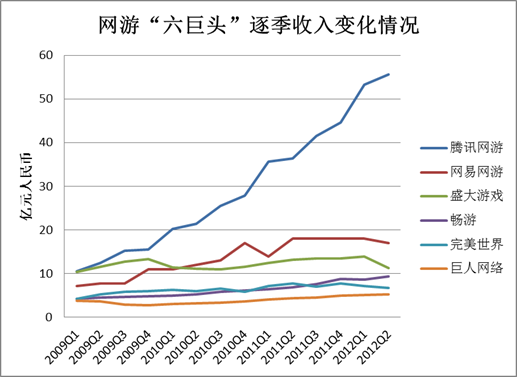

Changes of six giants’ income by quarters

As of yesterday, Tencent、NetEase、Shenda、Changyou、Perfect World、Giant, companies occupied 80% of the total online game market, have all released their earnings in the second quarter. It is remarkable that revenues of half the companies decreased quarter by quarter, including Shenda、Perfect World、Giant.

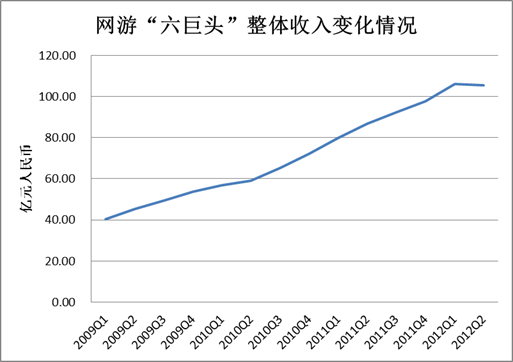

Changes of six giants’ total income

Since Shenda appeared on the market by fractionation in 2009,this is the first time of this situation, even worse than the depression of Q2,2012. However, it goes further than that.

Statistics show the total revenue of this six companies(with only online game income of Tencent and NetEase)exceeded 10 billion RMB in last quarter, and it fall from 10.6billion to 10.535 billion in this quarter. Though the differences is less than a hundred million, but this is the first time that the growth become negative after 2009.

This is obvious a dangerous signal for the industry.

In terms of revenue scale, the ranking of these six companies is the same as last quarter, but if we set retained profits as reference, we can see that Changyou have passed Shenda for the first time. Moreover, relying on the web games, Chanyou’s revenue is approaching Shenda, just a step to “1 billion revenue club” in a quarter.

Although the revenue of Shenda slumped 14% compared to the first quarter, retained profits increased 1% quarter to quarter. We can see from Shenda’s earnings that its costs declined 18% from last quarter , Shenda must have made great effort on this.

In this quarter, both Shenda and PerfectWorld have appointed new CFO, many investment banks gave them high ratings even their revenue declined. For example, Morgan Stanley consider that Shenda is good at subsequent products, cost controlling and cash flow, so they maintained overweight rating of Shenda ,only lowered the target price to $5.5.

While Citi predict that the weak performance of Perfect World will continue, meanwhile its report pointed out that the share price of Perfect World is underrated:” The net cash and cash equivalents Perfect World hold is equal to $6.5 per each share of ADS, reaching 62% of the share price, while the property values of company is $3.2per each share of ADS, reaching 30% of the share price.

The undervalue of share price、low market value never left chinese online game.

At this stage, the price-earnings ratio of Hong Kong-listed Tencent is 35 times, while US-listed NetEase is 12 times, Shenda 4.85 times, PerfectWorld 3.57 times, Giant 6.13 times.

中文链接:网游市场再生变:六巨头整体收入首次负增长

查看Changes six giants game income相关新闻

- 2012-12-12 任天堂GameBoy化身性感泳衣 看看不一样的泳装辣妹

- 2012-08-17 《行尸走肉》评测:体验视觉与听觉的最完美结合

- 2012-08-15 Game Insight:PVP是最好赚钱的方式

- 2012-08-03 魔兽已坠落 外媒评史上最好与最差的PC游戏

- 2012-07-26 手游界的双胞胎? 《大大大战争》火热进行中

- 2013-01-06 微软或在E3游戏展发布Xbox 720